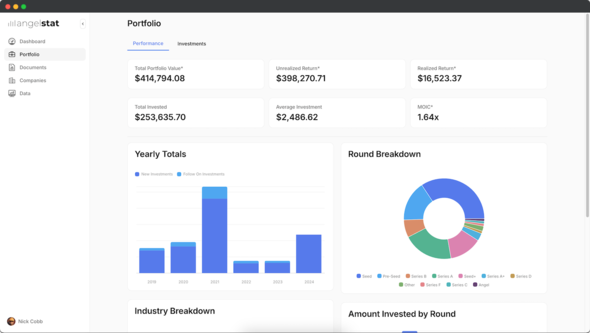

As we wrap up 2024, we're excited to share AngelStat's journey from launch to becoming a valuable resource for the angel investment community.

Read moreThe Portfolio CoPilot for Angel Investors

Manage documents, track investments, research companies, and analyze your portfolio performance across investment platforms in one simple tool. Better than your spreadsheet, on desktop and mobile.

×